By: Melissa Menard | Compass Los Angeles

Date: January 15, 2026

The Shift You Can Finally Feel

If you have been tracking the Los Angeles housing market over the last two years, you know the feeling well: The Waiting Game. Sellers were waiting for prices to peak; buyers were waiting for rates to drop; and everyone was waiting for certainty.

As we settle into January 2026, the wait appears to be over.

For the first time since the volatility of the mid-2020s began, we are seeing a convergence of data that signals a return to a functioning, healthy real estate market. It isn’t the frenzy of 2021, and it isn’t the deep freeze of 2023. It is something better: Balance.

Recent data from major financial indices reports that the 30-year fixed mortgage rate has dipped below the psychological 6% barrier in several daily trackers, with weekly averages stabilizing between 5.99% and 6.16%.

This isn’t just a number. It’s a signal. Here is what it means for your plans in Santa Monica, Sherman Oaks, and beyond.

The Math of 6%: Purchasing Power Restored

Let’s be direct about the numbers. Real estate is emotional, but it rests on a foundation of math. In 2024 and 2025, rates hovered in the 7% range. Today, securing a rate near 5.99% fundamentally changes your monthly obligation.

The Scenario: Let’s look at a $1,500,000 home purchase with 20% down ($1.2M loan).

- At 7.25% (2024 Average): Principal & Interest = ~$8,185/month.

- At 5.99% (January 2026): Principal & Interest = ~$7,185/month.

The Impact: That is a savings of $1,000 per month, or $12,000 per year. Over the life of the loan, the savings are astronomical. But more importantly, that $1,000/month might be the difference between a condo in West LA and a single-family home in Mar Vista. It’s the difference between “stretching” and “comfortable.”

Note: Rates vary by borrower credit, down payment, and loan product. Consult with a lender for your specific scenario.

The “Shadow Demand” Phenomenon

You might be asking: “If rates are down, why isn’t everyone rushing to buy?” The answer lies in what economists call Shadow Demand.

According to Compass market analysis, purchase mortgage applications are up 15-25% year-over-year, yet closed sales have only risen 2-4%. This gap represents you—the qualified, interested buyer who is watching the market but hasn’t pulled the trigger yet.

This “Shadow Demand” is a coiled spring. As news of the 6% rates spreads, we expect this demand to activate. The window where rates are low before competition heats up is typically very narrow. We are in that window right now.

Inventory: The Power of Choice

Perhaps the most refreshing change in January 2026 is the inventory landscape. Listings in Los Angeles are up approximately 20% year-over-year.

For the last few years, buyers had to settle. You took the house on the busy street because it was the only one available. Today, you have choices.

- Sherman Oaks & The Valley: We are seeing more inventory hit the market here than we have in five years. This is great news for move-up buyers looking for pool homes and better school districts.

- Westside Condos: Inventory is healthy, creating opportunities for first-time buyers to enter the market at a lower price point before trading up.

The “Builder’s Perspective”: Quality Over Speed With homes sitting on the market for an average of 56 days (up 9 days from last year), you finally have the luxury of due diligence. As someone with a background in construction, I tell my clients: Use this time.

Don’t waive inspections. Look past the fresh paint. Check the systems (HVAC, roof, foundation). In a balanced market, you can negotiate repairs. You can ask for credits. You can buy a home that is technically sound, not just aesthetically pleasing.

Neighborhood Watch: What’s Happening Locally?

Real estate is hyper-local. Here is what I am seeing on the ground:

- Santa Monica & Venice: The market remains competitive for turnkey homes, but “aspirational” pricing is being punished. Sellers who price correctly are seeing activity; those who overprice are sitting.

- Culver City: This area remains a hot spot for tech professionals. The new rates are fueling a resurgence in demand for townhomes and smaller single-family lots.

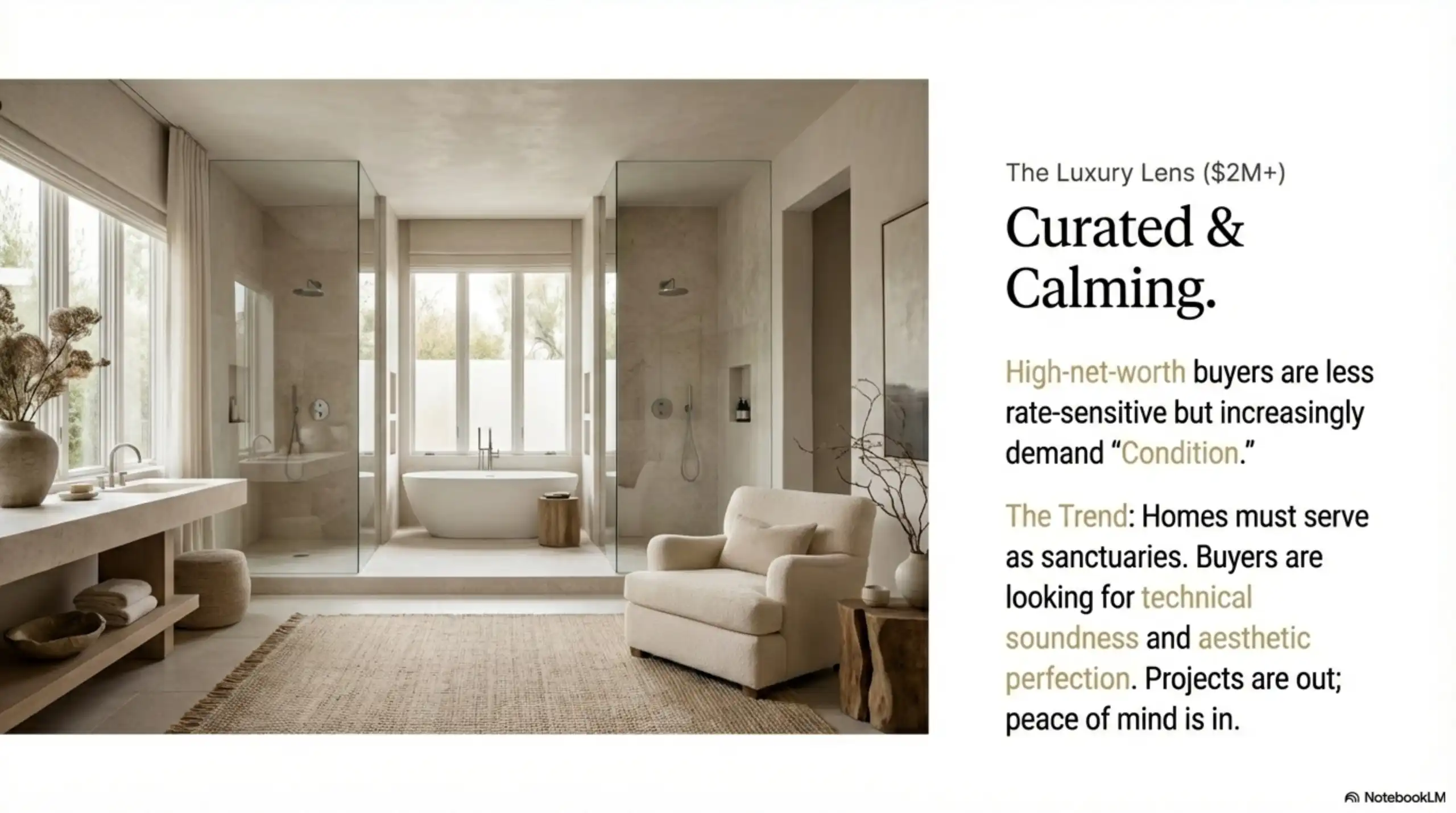

The Luxury Lens ($2M+) High-net-worth buyers are less rate-sensitive, but they are increasingly demanding “Condition.” The trend for 2026 is Curated & Calming—homes that serve as sanctuaries.

The Forecast: Stability, Not Speculation

What does the rest of 2026 look like? Most experts, including the Mortgage Bankers Association and Fannie Mae, predict rates will remain in the 5.5% to 6.5% range. Home prices in Los Angeles are expected to remain relatively flat or grow very modestly (0.1% to 1%).

This is good news. We don’t want a boom/bust cycle. We want stability. Stability allows you to plan your life without fear that the market will run away from you overnight.

The Bottom Line

January 2026 offers a rare combination: Lower rates, more inventory, and less frenzy.

If you have been waiting for a sign, this is it. But remember, the “Shadow Demand” won’t stay in the shadows forever. As spring approaches, we expect activity to ramp up.

Whether you are looking to sell your current home to capture this new buyer energy, or you are looking to buy while choices are abundant, let’s have a conversation. Real estate is about people, not just property—and I’d love to help you navigate this new landscape.

Melissa Menard REALTOR® | Compass

The Greater Los Angeles Area

📞 310.729.9726 | DRE# 01858710

📧 melissa@melissamenardhomes.com

🌐 www.MelissaMenardHomes.com

SOURCES: CBS News, Freddie Mac, Zillow, Compass Research. Date: January 14, 2026.