The real estate market lives and dies by uncertainty, and for the last two years, the biggest question mark has been mortgage rates. As of January 22, 2026, the 30-year fixed-rate mortgage averages 6.09%, according to the latest Freddie Mac Primary Mortgage Market Survey.

While this is a slight uptick from last week’s 6.06%, the bigger picture is what matters: rates are down significantly from nearly 7% just a year ago. For buyers in Los Angeles, this shift offers a window of opportunity that hasn’t existed since 2022. But with increased affordability comes increased competition. Here is what you need to know to navigate this pivot in the market.

Best for: Buyers and sellers hesitating due to rate volatility or waiting for the “perfect” bottom.

Decision Takeaway: Rates are nearly 1% lower than last year, significantly boosting purchasing power, but waiting for further drops may cost you in home price competition.

Key considerations:

- 30-Year Fixed Rate: 6.09% (as of Jan 22, 2026).

- Year-Over-Year: Down from 6.96% a year ago.

- Market Impact: Lower rates are already bringing more buyers off the sidelines, increasing competition for desirable LA homes.

Next Smart Step: Run updated numbers with a lender immediately; your budget today is likely higher than it was six months ago.

The “Wait and See” Strategy Is Becoming Risky

For the past 18 months, many Los Angeles buyers have paused their search, hoping for rates to drop back to the 5% range. While rates have indeed trended down, waiting for the absolute bottom is a strategy that often backfires.

Why? Because interest rates and home prices typically move in opposite directions. As rates fall, affordability improves. This brings a flood of pent-up demand back into the market. In a supply-constrained city like Los Angeles—from the Westside to the Valley—increased demand almost always pushes home prices up.

If you wait for a 5.5% rate but home prices rise by 5–10% in the meantime, your monthly payment may end up being the same (or higher), but you will have lost equity and leverage during negotiations.

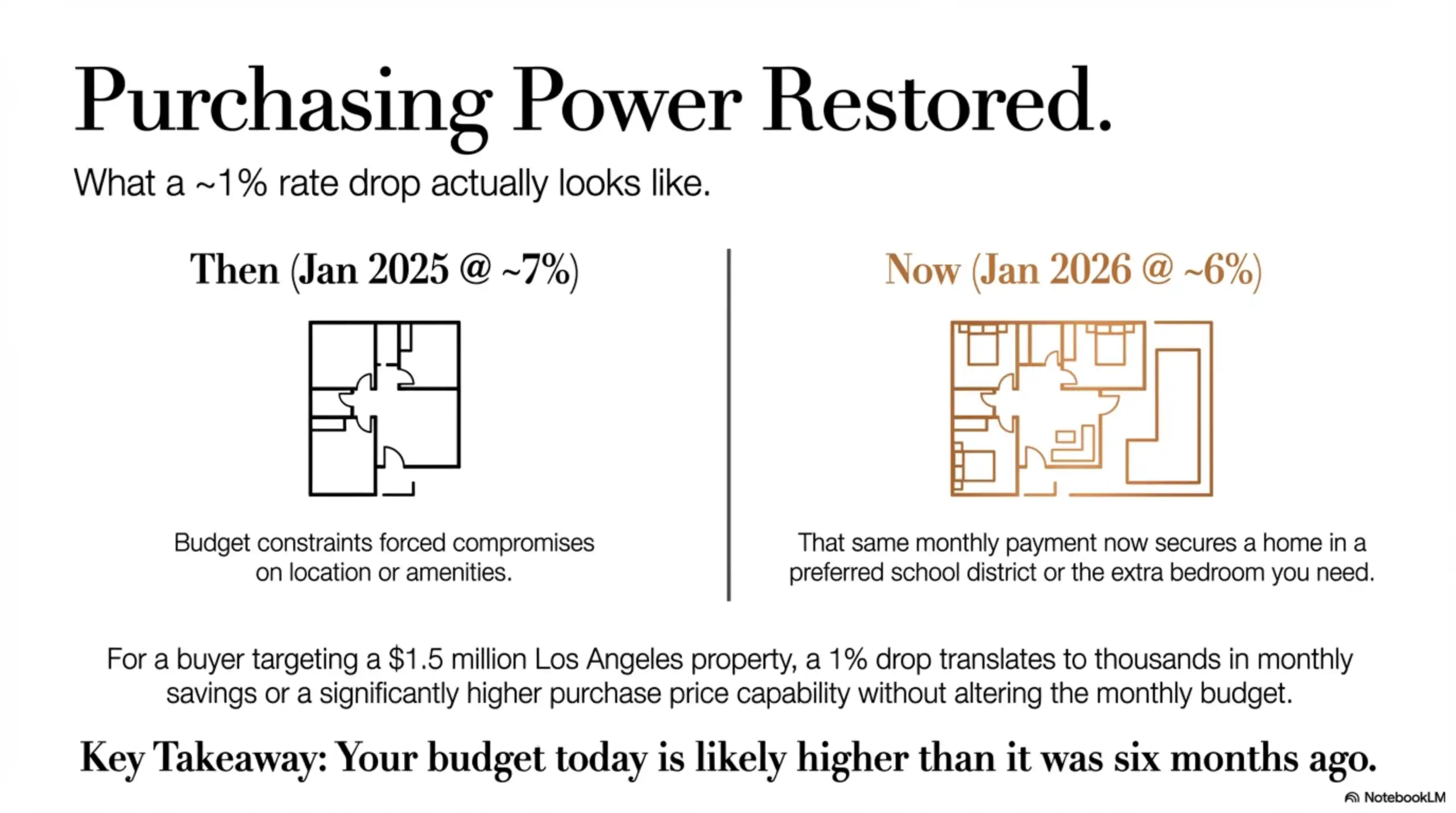

Purchasing Power Has Returned

The most concrete impact of the current 6.09% rate (versus nearly 7% last year) is the restoration of purchasing power.

For a buyer looking at a $1.5 million home in Los Angeles, a 1% drop in interest rates can translate to thousands of dollars in monthly savings—or the ability to qualify for a higher price point without changing your monthly budget.

- Last Year (approx. 7%): Your budget might have been tight, forcing compromises on location or amenities.

- Today (approx. 6%): That same monthly payment might now secure a home in a preferred school district or with the extra bedroom you need.

Navigating the “New Normal” in Los Angeles

We are seeing the market wake up. Open houses are busier, and well-priced homes in desirable neighborhoods are seeing multiple offers again.

Actionable Takeaways for Q1 2026

- Update Your Pre-Approval: If your pre-approval is older than 30 days, it is outdated. Have your lender run numbers at the new 6.09% benchmark.

- Focus on “Date the Rate”: Remember that a mortgage is financial leverage, not a life sentence. If rates drop significantly in the future, refinancing is often an option. If prices rise, however, you cannot go back and buy at yesterday’s price.

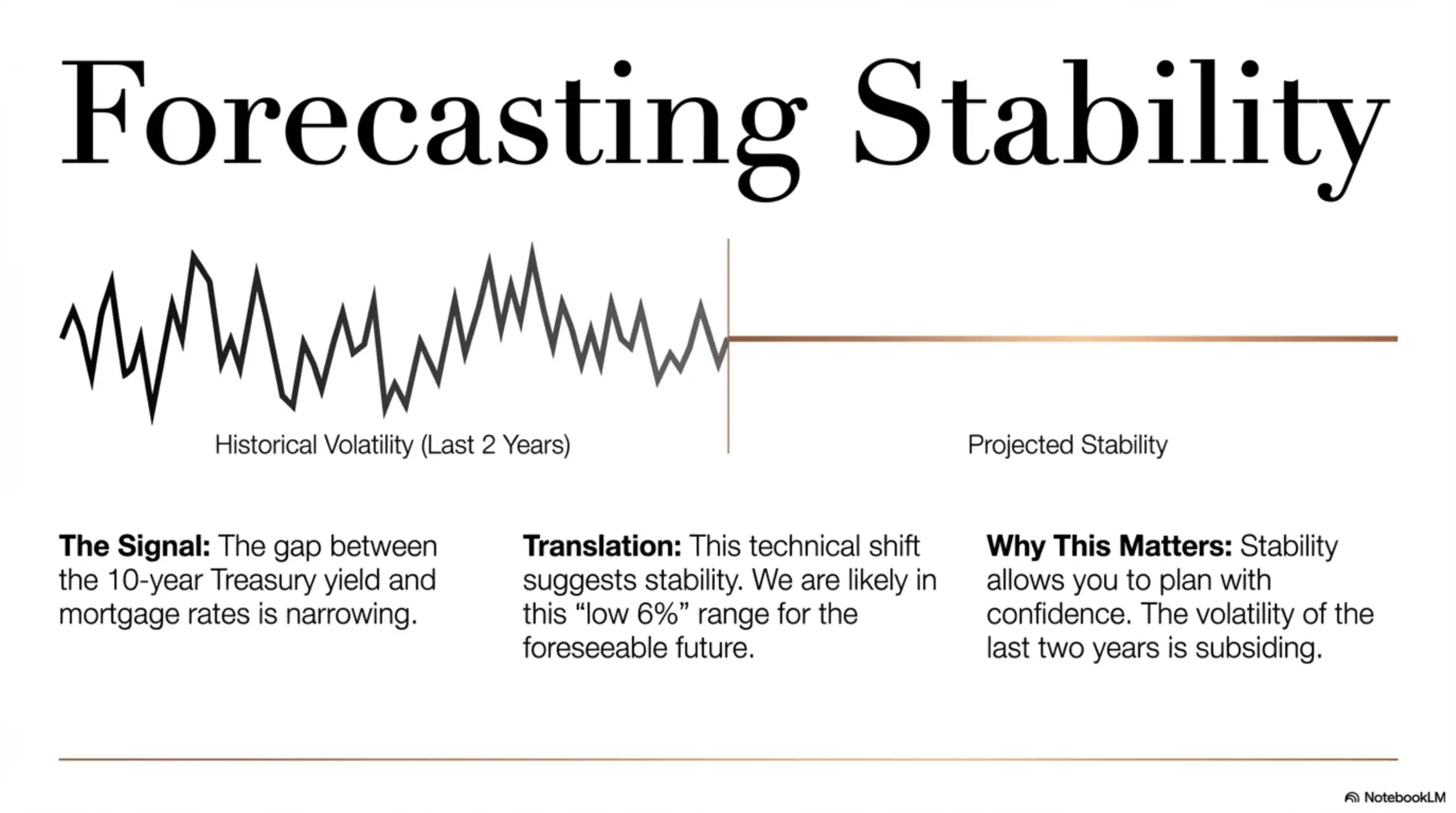

- Watch the Spread: The gap between the 10-year Treasury yield and mortgage rates is narrowing. This technical shift suggests stability, meaning we may be in this “low 6%” range for a while. Stability is good—it allows you to plan with confidence.

Conclusion

The data is clear: we are in a more favorable lending environment than we were a year ago. The window to buy with less competition, however, is closing as more buyers realize the math has changed. If you have been waiting for a sign that the market is shifting, this is it.

Frequently Asked Questions

What is the current 30-year fixed mortgage rate in Los Angeles? As of January 22, 2026, the national average for a 30-year fixed-rate mortgage is 6.09%, according to Freddie Mac. Rates can vary based on your credit score, down payment, and loan type, so local quotes may differ slightly. Consult with a local lender to get a rate specific to your financial profile.

Should I wait for rates to drop to 5% before buying? Waiting carries risk because lower rates usually increase buyer competition, driving home prices up. You may save on the rate but pay more for the house, negating the benefit. Run a “cost of waiting” analysis to see if delaying makes financial sense for you.

How does the current rate compare to last year? Rates have improved significantly; the 30-year fixed rate was roughly 6.96% at this time last year. This drop of nearly 1% has restored substantial purchasing power to buyers. Review your budget today—you may be able to afford more home than you could twelve months ago.

Will home prices drop if rates stay in the 6% range? It is unlikely. In Los Angeles, inventory remains low, and demand is picking up as rates stabilize. Historically, stable rates in the 6% range support steady or rising home prices rather than declines. Check the latest market data for your specific target neighborhood.

Is it a good time to sell my house in Los Angeles? Yes. Lower rates mean more buyers can afford your home, potentially leading to faster sales and better offers. The “lock-in effect” (sellers staying put due to low rates) is easing, creating more liquidity in the market. Request a home valuation to see where your property stands in today’s shifting market.

What is the 15-year fixed mortgage rate right now? The 15-year fixed-rate mortgage averaged 5.44% as of January 22, 2026. This option is popular for homeowners looking to refinance or buyers who want to build equity faster and pay less interest over time. Ask your lender to compare monthly payments for 15-year vs. 30-year terms.